More enterprises ≠ less risk

Feb 19, 2026

Five years of benchmark data farmers rarely see

I’m going to have a bit of a rant.

Because this keeps coming up.

Especially right now.

After a couple of tough years.

Tight margins.

Rising costs.

Fatigue.

A lot of farm owners are asking the same question:

“Do we need to add another enterprise?”

And almost every time, the advice they get sounds like this:

“Diversify.”

“Don’t have all your eggs in one basket.”

“More enterprises will reduce risk.”

That advice has been passed down for generations.

It sounds responsible.

It sounds conservative.

It sounds smart.

But when you actually stress-test it in real farm businesses…

It often makes things worse.

Here’s the part that frustrates me.

Most people talk about diversification like it’s some magic safety blanket.

As if simply having more enterprises automatically makes a business safer.

It doesn’t.

What usually happens in practice is this:

Farm businesses add another enterprise…

…at a scale that is completely uncompetitive.

Then they add another one.

And another.

Each one:

- Too small to stand on its own

- Too dependent on the owner

- Too exposed to price and season

- Competing for the same labour, capital, machinery, and headspace

So instead of spreading risk…

They spread attention.

They spread decision quality.

They spread management thin.

And then they wonder why the whole thing feels harder than it should.

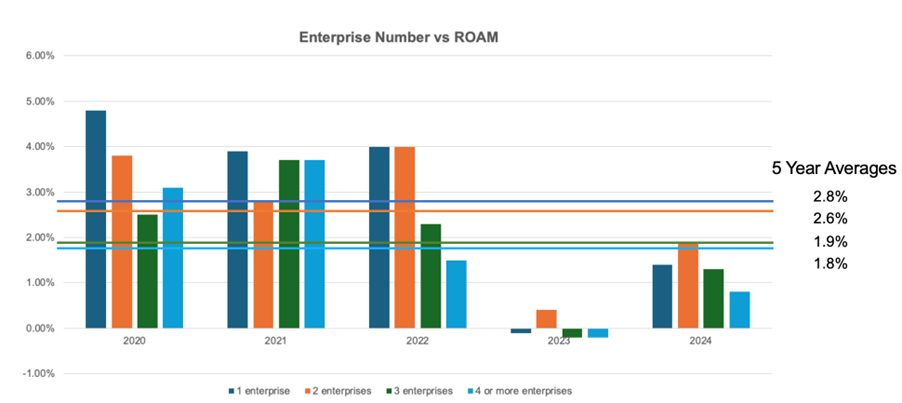

Here’s what our benchmark data shows over five years.

On average, the more enterprises a business runs, the lower the return on assets.

Not because mixed farming is bad.

Not because livestock and cropping can’t work together.

But because complexity has a cost.

Execution risk.

Decision overlap.

Capital drag.

Mental load.

None of that shows up in a “diversification” spreadsheet.

Another thing that rarely gets said.

A lot of commodities are correlated anyway.

Prices move together.

Input costs move together.

Seasons hit everything at once.

So the diversification people think they’re getting often disappears exactly when they need it most.

Bad year?

Both enterprises hurt.

At the same time.

While still fighting for the same resources.

And here’s the line that usually makes people uncomfortable.

If you don’t intend to scale an enterprise to at least $750k p.a. net trading income per year, I would seriously question why you’re starting it.

Below that level, most enterprises:

- Are fragile

- Are heavily owner-dependent

- Don’t absorb shocks well

- And quietly drain focus from the core business

That’s not diversification.

That’s a hobby with overheads.

What actually reduces risk isn’t more enterprises.

It’s fewer enterprises run properly.

At scale.

With focus.

With discipline.

When you get one enterprise truly competitive…

…with a low cost of production

…and profitable across most price scenarios

It becomes far more resilient than three average enterprises limping along.

And if your real goal is diversification?

The data suggests something far more effective.

Build one (or at most two) enterprises that consistently throw off surplus cash.

Then use that profit to invest in income-generating assets off farm.

That’s where diversification actually becomes uncorrelated.

That’s where risk genuinely reduces.

Not by adding another enterprise that competes for your time and sanity.

This is exactly the kind of conversation we’ve been having at the TOP Producers Workshop.

Not “should we add something else?”

But “what are we making unnecessarily hard?”

“What deserves to be bigger?”

“And what probably shouldn’t exist at all?”

If you’re coming off tough years and feeling the pull to add complexity…

Pause.

Pressure is when bad diversification decisions get locked in.

If you want a sounding board, book a discovery call with one of our coaches.

We’ll understand your current situation, your goals and the things that are slowing you down or holding you back.

Not to tell you what to do.

But to stop you blindly repeating advice that no one ever properly tested.

Regards

Sam Johnsson

CEO, Farm Owners Academy

P.S. Adding another enterprise won’t fix a structure problem. If you’re serious about building a business that scales without exhausting you, it starts with getting brutally clear on what should grow and what shouldn’t exist.

Book a Discovery Call with one of our coaches and we’ll help you identify your biggest bottleneck and map out your next steps with clarity. Click here.